68% of Millennials Miss Out on This

A good majority of Millennials are missing out on a key part of financial success and sustainability. Why? 68% of Millennials are not contributing to their 401(k) – or any other retirement account, for that matter.1 Planning for the future brings financial peace of mind.

A good majority of Millennials are missing out on a key part of financial success and sustainability. Why? 68% of Millennials are not contributing to their 401(k) – or any other retirement account, for that matter.¹ Planning for the future brings financial peace of mind. Here are some reasons why retirement contributions are so important and how you can get started.

Save Now for More Money Later

The sooner you start saving, the better off you’ll be in retirement. And who doesn’t want a solid financial future?

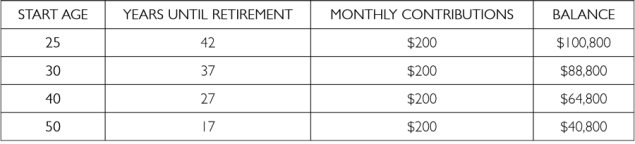

Let’s say that when you decide to start saving for retirement, you save $200 a month until you retire at the age of 67. Take a look at the table below and see how the balance of your retirement savings would change depending on how soon you start saving.

That’s if you simply set aside $200 – no interest, no investment dividends, just $200 a month consistently. If you make those monthly contributions to an investment account with annual returns or compound interest, your balance would go up even more! Bottom line? The earlier you start, the larger your nest egg.

Ask your benefits manager about the retirement savings plan offered through your employer, like a 401(k) or TSP. You can also consider opening an account on your own – common ones being a Traditional or Roth IRA (Individual Retirement Account). Most plans have an option for automatic deposits, so you don’t have to worry about remembering to contribute each month.

Keep in mind that there are tax responsibilities and general pros and cons associated with each retirement account option, so talk with a Money Coach before moving forward. You can work with a whole team of Money Coaches made up of retirement specialists, tax specialists, and more, so you can make a well-informed decision and choose the best plan for you.

The Longer You Put It Off, the Bigger the Burden

Think of it this way, if you keep putting off saving for retirement, you could end up doing one of the following:

- You never actually set anything aside and end up working through retirement. Over half of Americans (53%) think they’ll have to work during retirement,² and over half of Americans (56%) will most likely fall short with their finances in retirement.³

- You eventually start saving, but because you have little time and many financial responsibilities – like a mortgage – you can only save so much. 1 in 5 Millennials contribute less than the max to a 401(k) because they have student loans, other debts, and are saving for their children’s education.⁴

- You start saving money and realize you need to increase contributions in order to meet basic necessities. Consequently, you start setting aside the majority of your paycheck towards retirement, foregoing discretionary spending and other savings goals – like gifts for the grandkids or a much needed vacation – for the sake of your future.

Here’s an example with actual numbers. Say you have a goal of saving $500,000 by the time you retire at age 67. Here’s how much you would have to save each month in order to meet your goal, depending on how old you are when you start saving:

Would you rather save $290 a month or have to save $2,530 a month?

The good news is that you can save for retirement without feeling the major burden of adding another financial responsibility, because every little bit counts! Not sure where to start? A good first step is looking at your monthly income and expenses. Once necessities are taken care of (e.g. rent, utilities, etc.), consider how much money you have left over that can go towards retirement.

Your Money Coach can direct you to calculators that will help you calculate just how much you need to save for retirement, and how much your contributions will amount to in the future. Your coach will also help you work on a budget that includes both long term goals and daily expenses.

You’re Leaving Money on the Table

If you have an employer who matches your 401(k) contributions in some way (meaning they will also make contributions to your account based on certain parameters) but you aren’t contributing enough to get the match, you’re leaving money on the table!

Some employers will match up to a certain percentage; for instance, an employer might match an employee’s contributions dollar-for-dollar for the first 3% of the employee’s wages, and match fifty cents on the dollar for the next 2%. Here’s an example using those parameters: an employee who annually contributes 5% of his $50,000 salary would be putting $2,500 into his 401(k) each year with an employer match of $2,000. If that same employee only contributes 1%, he would be allocating $500 a year with an employer match of $500, which would mean that each year he’s leaving $1,500 on the table.

Almost half of employers are now matching employees’ 401(k) contributions dollar-for-dollar to a certain extent, according to Employee Benefit News,⁵ so it’s worth asking your benefits manager if your employer offers matching contributions, and if they do, consider increasing your own contributions in order to get the full match. Keep in mind, though, that increasing your contributions will decrease your take home pay, so keep a close eye on your spending, after you increase your contributions, to make sure you’re still living within your means.

The Best Next Step

Did you know that a recent study for the U.S. Department of Labor found that people who receive financial guidance are more likely to plan, save, and feel confident about retirement?⁶ You can receive unbiased, trustworthy guidance from a Money Coach who is also a Retirement Specialist. Together, you can complete a retirement analysis, create and implement an action plan for long-term goals, and feel secure about your future.

On top of that, Money Coaches can talk about virtually any financial topic, so if you’re wondering about the student loan process, minimizing your mortgage problems, maximizing your investments, or some other financial topic… now is the time to reach out to a Money Coach. Call 888-724-2326 today.

¹Gladych, Paula Aven. “Majority of Millennials Not Participating in 401(k) Plans.” benefitnews.com. EBN, 26 May 2016. Web. 27 May 2016.

²Financial Security and Mobility. “Pew Survey Shows Americans’ Financial Worries Cloud Optimism: Sense of Improving Conditions Outweighed by Feelings of Insecurity.” pewtrusts.org. Washington: The PEW Charitable Trusts, 5 Mar. 2015. Web. 19 Aug. 2015.

³Woolley, Suzanne. “Here’s the toll that student debt can take on retirement.” benefitnews.com. EBN, 4 Feb. 2016. Web. 5 Feb. 2016.

⁴Retirement Saving and Spending Study. T. Rowe Price, 2015. Web. 27 May 2016. PDF.

⁵Gladych, Paula Aven. “Use of Dollar-for-Dollar 401(k) Matching Grows.” ebn.benefitnews.com. EBN, 21 Oct. 2015. Web. 27 Oct. 2015.

⁶Burke, Jeremy and Angela A. Hung. “Do Financial Advisors Influence Savings Behaviors?” dol.gov. Santa Monica, CA: RAND, Aug. 2015. Web. 4 Nov. 2015. PDF.

More Like This

Hackers are out there, ready, willing and able to sell our identities. A hard-hitting example of this was the 2017 Equifax data breach, which affected over 140 million people. We still hear about data breaches in the news on a regular basis. The Equifax data breach reminds us that we should take daily steps to […]

It’s more fun dreaming of sugarplums than worrying about identity theft, but the holiday season calls for extra attention to all the fraudsters out there. After all, you don’t want the holiday cheer suddenly slipping away because you found out someone got a hold of your credit card and went on a shopping spree for […]

Check out the resources available to you through My Secure Advantage (MSA)! This blog post provides resources specific to natural disasters and the recent California fires. My Secure Advantage Can Help Leverage the experience and peace of mind that a Money Coach can offer during this stressful time: Knowing where to start and how you […]

You asked. We listened. MSA Wallet® now offers a new suite of features making it easier to budget, save, and get a clear view of your finances. Our video takes you on a ride through MSA Wallet, and the details on the latest features are below. Check them out! More Categories Here’s the scoop: […]