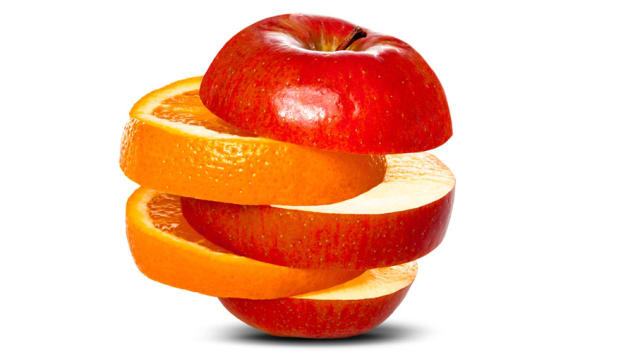

Apples & Oranges

Comparing the Average 401(k) Benefit and the MSA Financial Wellness Program Comparing apples and oranges reveals one similarity: they’re both fruit.

Comparing the Average 401(k) Benefit and the MSA Financial Wellness Program

Comparing apples and oranges reveals one similarity: they’re both fruit. Likewise, if you compare the 401(k) benefit with the MSA Financial Wellness program mentioned in this article, you will find one similarity: they’re both financial benefits.

re·tire·ment pro·gram noun

- Also known as a 401(k) plan, it is a financial benefit that allows employees to make contributions towards retirement and take the occasional loan for financial hardship.

- A plan for setting aside money to be spent during retirement.

MSA fi·nan·cial well·ness pro·gram noun

- A financial wellness benefit that improves and maintains financial wellness through the multifaceted approach of education, one-on-one coaching and on-going support.

- Personalized coaching tailored towards improving behaviors and achieving individual challenges and goals.

The 401(k) benefit and the MSA Financial Wellness program also have their differences, just as apples and oranges do. The following chart shows the main elements that distinguish the MSA program from the average retirement program:

Employee Benefits

MSA

401(k)

Pre-tax contribution

–

Yes

Holding & investment of contributions

–

Yes

Educational content (web, class, self-help)

Yes

–

Personal Money Coach

Yes

–

Coaching & education on all areas of finance

Yes

–

Helps decrease 401(k) withdrawals

Yes

–

Helps boost employee 401(k) contributions

Yes

–

Provides a custom financial wellness analysis

Yes

–

Helps employees with money challenges

Yes

Penalty to take loan

Establishes relationships, accountability & guidance

Yes

–

Necessary for achieving financial wellness

Yes

Yes

Why Employers Need Both

70 million workers have 401(k) plans which help secure their retirement funds,¹ but 19% say they would use 401(k) funds to cover emergency expenses.² With the MSA benefit, if a member falls on hard times, they discover other options besides compromising their financial future and using retirement funds to meet present needs.

Where the retirement benefit focuses on future finances, the MSA benefit broadens the horizon to include all financial avenues; that way, people can reap the benefits of smart money management in all stages of life. The MSA benefit and a retirement benefit are as different as apples and oranges, but they’re both “nutritious” and essential for an employee’s financial well-being. Make a positive impact on your employees’ financial futures with the MSA Financial Wellness program. To learn more or get started, call us today.

More Like This

Money is already a top stressor for U.S. households, and when individuals are constantly bombarded with anxiety-provoking messages about inflation, job security, and more, their stress can grow. It might seem that providing more resources is the simplest solution, but giving more information when employees are already struggling can make their situations worse. To streamline […]

Cash-strapped employees are looking at all options to make ends meet, but are they coming to the right conclusions?

The rising costs of medical bills and medications, on top of the steady rise in household expenses, as well as the stress of providing care, have pushed many workers to a breaking point.